Understanding the Shifts in Australian Household Spending: Insights into 2023

The financial scene in Australia has caught the eye of many, following the latest quarterly report from the Australian Bureau of Statistics (ABS) for the end of the year. This report reveals a 2.5% fall in household spending per person throughout 2023. This downturn is noted as the most significant since the financial crisis in 2008, not counting the periods hit by the pandemic.

Delving into Household Expenditure

The ABS’s January Household Spending Indicator sheds more light, showing a mere 3.0% rise in household expenditure in 2023. When placed against the backdrop of a 4.1% inflation rate and a 2.5% population growth, it’s clear that household budgets are under strain. The growth in spending isn’t keeping up with inflation, squeezing budgets even further.

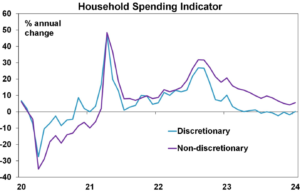

Shane Oliver, the leading economist at AMP, offers a deeper understanding with a chart that compares household spending indicators with final household consumption. This comparison highlights a significant reduction in non-essential spending, amidst rising living costs.

Source: Shane Oliver (AMP)

Insights on Spending Trends: The CBA’s Analysis

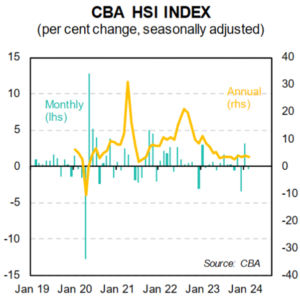

In February, the Commonwealth Bank of Australia (CBA) released its Household Spending Insights (HSI) index, which tracks transaction data from about seven million customers. The HSI showed a slight drop of 0.3% in February, suggesting a continuation of the decrease in household spending since the highs.

Source: CBA

Economic Consequences and What Lies Ahead

Consumer behaviour is significantly affecting Australia’s economic slowdown. With inflation expected to remain between 3.5% and 4% in February, real spending is almost flat and declining on a per-person basis.

In its latest statement the RBA has remained cautious and has reinforced the view that taming inflation is its number one priority. Job data is still see-sawing and recently surprised with more job creation in the latest numbers.

Migration is the largest swing factor for Aussies and is the cause of many of the inflationary inputs. Whilst job creation remains steady, there may need to be a tipping of the scales to greater unemployment to slow things down. Policymakers must watch these trends closely to strike the right balance between encouraging growth and managing inflation. Trying to land rates with the Goldilocks principle of not too hot or too cold has proven difficult in past cycles.

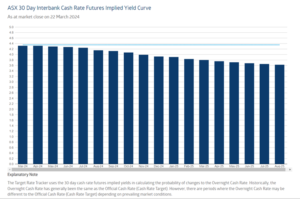

The futures market is still pricing in rate cuts this year. The 30 day Interbank Cash Rate Implied Future Yield for December 2024 has dropped from 3.965% to 3.915% post the February job data release.

As with everything in life, time will tell but no doubt we will all be smarter with hindsight.

Source: ASX

Disclaimer: This may contain general advice. It does not take account of your objectives, financial situation or needs. You should talk to a financial adviser before making a financial decision. This has been prepared by Dollar Growth Financial Advice Pty. Ltd. refer to the Financial Services Guide for details. While care has been taken in the preparation of this, no liability is accepted by Dollar Growth Financial Advice Pty. Ltd., its related entities, agents, representatives, employees for any loss arising from reliance on the information contained herein.