The Rise in Australian CPI Inflation and Its Impact

In March 2024, the Australian Bureau of Statistics (ABS) revealed a notable rise in the Consumer Price Index (CPI), with a quarterly increase of 1.0% and an annual rate of 3.6%. This growth exceeded the expectations of many economists who anticipated a more modest rise. The increase has significant implications, especially concerning financial planning and achieving financial independence.

Key Areas Affected by Price Increases

The ABS report highlighted significant price increases across several vital sectors:

- Education: Costs rose by 5.9%.

- Health: Prices increased by 2.8%.

- Housing: There was a rise of 0.7%.

- Food and Non-Alcoholic Beverages: Prices went up by 0.9%.

Within the housing sector, rental prices jumped by 2.1%, while the cost for new dwellings purchased by owner-occupiers increased by 1.1%. The rental market experienced a notable annual increase of 7.8%, the highest since March 2009, driven by low vacancy rates and a tight market. New dwelling construction is anaemic, with rising costs for materials and labour exacerbating the situation, pushing up prices for existing dwellings and making it harder for new buyers to enter the market. Higher lending rates are widening this divide further.

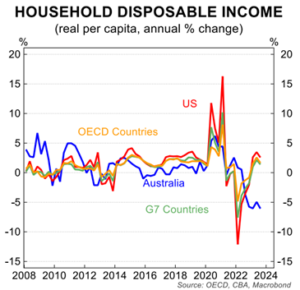

The difference in household disposable income can really be seen in comparison to other developed economies.

Economic Implications of Surging Inflation

The unexpected spike in inflation complicates monetary policy, affecting decisions about interest rate cuts this year. Persistent inflation suggests that without strategic measures, high inflation could continue, fuelled by broader economic challenges and policies such as increased immigration under the current government. “Alboflation,” may have kept the Australian economy from recession but has introduced a new set of challenges.

The impact of inflation affects long-term financial goals. Here are three steps to consider:

- Review Your Budget: Regularly update your budget to reflect rising costs and manage financial pressures effectively.

- Plan for Higher Costs: Prepare for potential increases in essential sectors like housing, health, and Financials such as Insurance.

- Stay Informed: Keeping abreast of economic trends can help you adjust your financial strategies proactively.

Conclusion

If the current government continues its policies, inflation will remain high. The recent data on CPI is vital for everyday Australians and policymakers alike. While the strong inflation figures have impacted the likelihood of rate cuts this year, we have confidence we are close to peak rates but retain our view that rates will stay their course of higher for longer.

Disclaimer: This may contain general advice. It does not take account of your objectives, financial situation or needs. You should talk to a financial adviser before making a financial decision. This has been prepared by Dollar Growth Financial Advice Pty. Ltd. refer to the Financial Services Guide for details. While care has been taken in the preparation of this, no liability is accepted by Dollar Growth Financial Advice Pty. Ltd., its related entities, agents, representatives, employees for any loss arising from reliance on the information contained herein.